Resources

Refill, Return, Reimagine: Innovative Solutions to Reduce Wasteful Packaging

Single-use plastic packaging is so common in our everyday lives that a future without it might seem a long way off. But examples of what that future might look like are already here.

Featured Resources

Truth in recycling

Guide to planting a pollinator-friendly garden

Junk fees should be banned, U.S. PIRG tells FTC

Type

Issue

‘Failing the Fix’ scorecard grades Apple, Samsung, Google, others on how fixable their devices are

Nobody walks into an electronics store and thinks, “I’m going to buy something that breaks.” Our scorecard helps you choose a repairable phone or laptop from a brand which supports your Right to Repair.

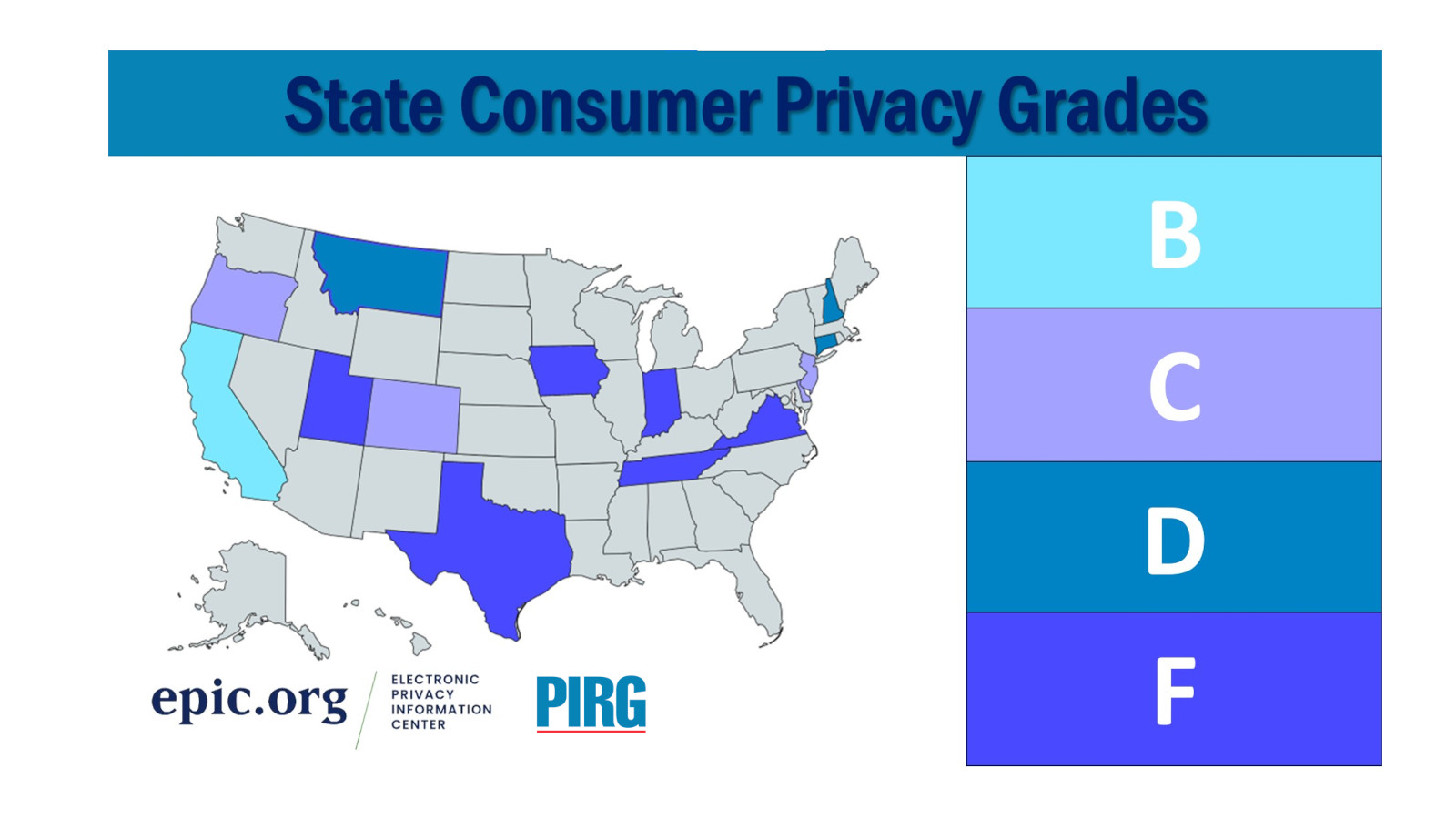

Why lots of states are passing bad state privacy laws

Of the 14 states that have passed data privacy laws, nearly half of them receive a failing grade.

How to use iPhone privacy settings 2024

iPhone privacy settings help cut down on the amount of data Apple and other companies can gather about you. Here's how to use them.

5 steps you can take to protect your privacy now

This National Consumer Protection Week, take more control of your personal information.

Plastic bag bans work

Well-designed single-use plastic bag bans have successfully reduced plastic bag use and associated litter and pollution. Use the Single-use Plastic Bag Ban Waste Reduction Calculator to estimate the impact where you live.